The EUR/USD currency pair traded with notable volatility on Monday. Particularly for a so-called "boring Monday," with no significant events scheduled. Yet yesterday was anything but boring—many experts have already labeled it a "black" day. The stock markets experienced an unprecedented decline, and the cryptocurrency and oil markets traded lower all day. This article focuses on the currency market, especially the U.S. dollar, which has depreciated since Donald Trump took office...

On Monday, the U.S. dollar even managed to gain a bit. But what does this tell us? In our view—nothing substantial. Even though the global downward trends (on the daily and monthly timeframes) remain bearish—and we expect them to continue—it's hard to believe the market sentiment flipped from "sharply negative" to "optimistic" in just one day. In other words, if the market had been selling off the dollar on every report of Trump's tariff announcements, what changed now? Of course, the dollar won't fall forever—and it may have already overshot to the downside—but expecting it to strengthen back to parity with the euro seems unlikely. Even though that is what the long-term trends are pointing toward.

Naturally, Jerome Powell's speech on Friday played a role. The Fed Chair once again made it clear to the market—and personally to Donald Trump—that he has no intention of playing along with the president's games. Trump has a very peculiar strategy: he does whatever he wants and expects everyone else to fall in line. He still expects the Fed to slash rates nearly to zero, but it's worth repeating that the Fed is independent of the President and Congress. Powell reaffirmed on Friday that he will not cut rates simply because Trump wants him to.

Moreover, as we've said before, the Fed may not lower the key rate in 2025. U.S. inflation is not too high—at 2.8%, which may drop to 2.5% this week. However, all market participants understand perfectly well that trade tariffs will lead to a new wave of consumer price inflation. It's only a matter of time. Since Powell reiterated that the Fed's main mandate is price stability, it's easy to conclude that the central bank will only cut rates for valid macroeconomic reasons.

This very stance allowed the dollar a brief moment to regain its footing. But how long will this pause last? The European Union is already preparing to impose retaliatory tariffs this week. All signs point to the global trade war escalating further.

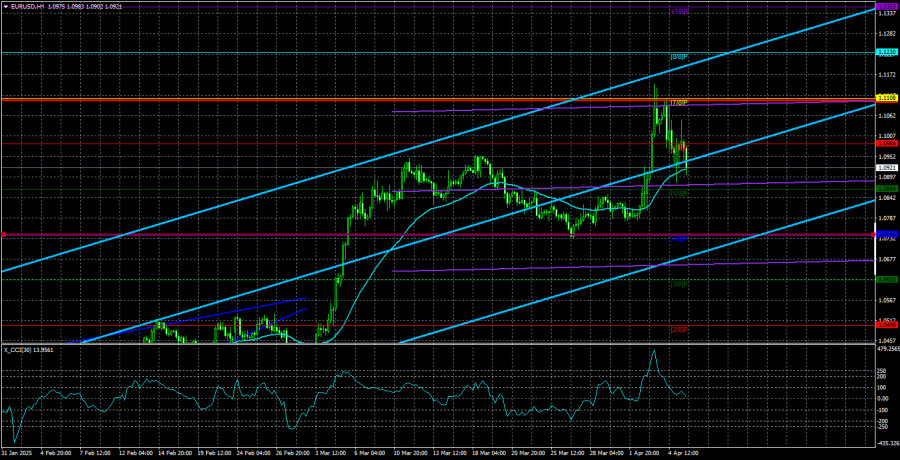

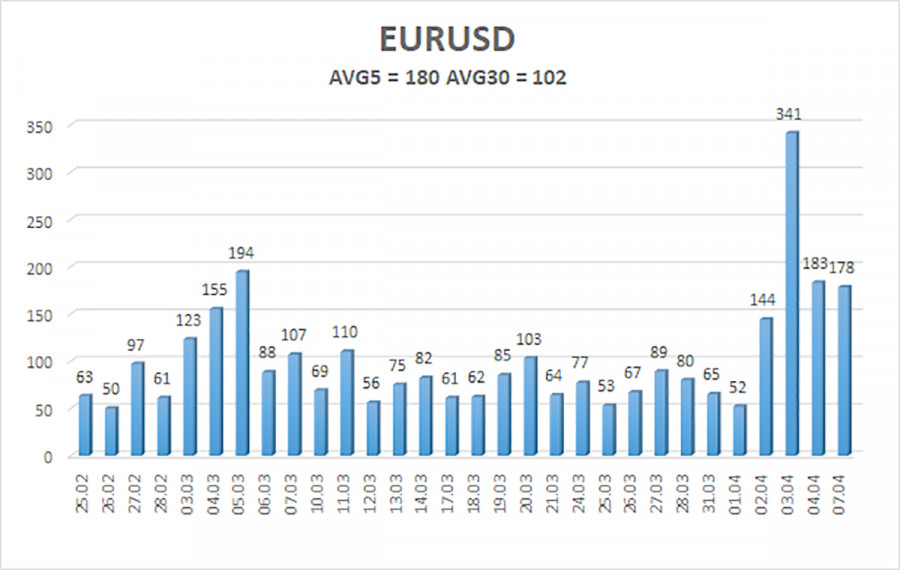

The average volatility of the EUR/USD currency pair over the last five trading days as of April 8 is 180 pips, which is classified as "high." On Tuesday, we expect the pair to move between the levels of 1.0742 and 1.1102. The long-term regression channel is pointing upward, indicating a short-term uptrend. The CCI indicator entered overbought territory, signaling a potential correction, but the trend remains upward for now.

Nearest Support Levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest Resistance Levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading Recommendations:

The EUR/USD pair maintains its upward trend. We have been stating that we expect a medium-term decline in the euro for months, and nothing has changed. The dollar still has no objective reasons for a medium-term fall—except for Donald Trump. However, that one factor alone continues to drag the dollar into the abyss. This situation is unprecedented and quite rare for the currency market.

Short positions remain attractive, with targets at 1.0315 and 1.0254. However, it's challenging to say when the Trump-driven rally will end or how many more tariffs and sanctions the U.S. president plans to introduce. If you trade based solely on technicals, long positions can be considered as long as the price remains above the moving average, with targets at 1.1108 and 1.1230.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.