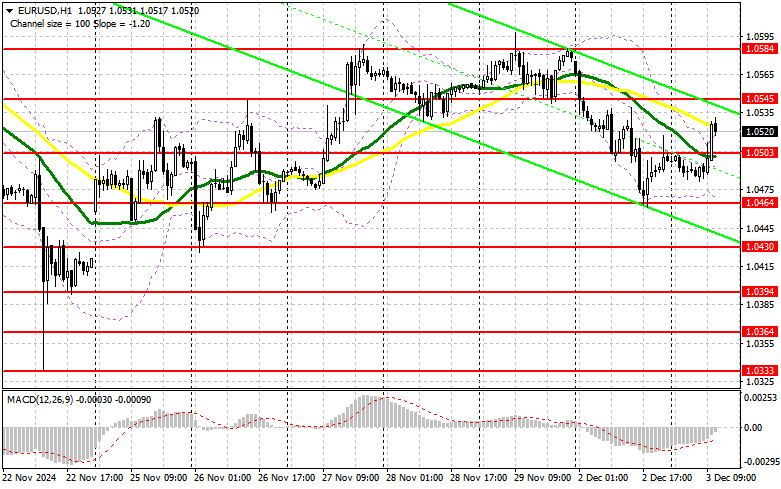

In my morning forecast, I focused on the 1.0500 level and planned market entry decisions around it. Let's examine the 5-minute chart to analyze what occurred. The rise and formation of a failed breakout around 1.0500 provided a potentially profitable entry point for short positions within the bearish market trend. However, the pair failed to decline, resulting in losses. The technical outlook has been revised for the second half of the day.

To Open Long Positions on EUR/USD

The euro rebounded despite the absence of significant economic data, but challenges for euro buyers may resurface. The focus now shifts to the Job Openings and Labor Turnover Survey (JOLTS) from the US Bureau of Labor Statistics and the Economic Optimism Index by RCM/TIPP.

Attention will also be on whether FOMC members Adriana D. Kugler and Austan D. Goolsbee echo yesterday's cautious rhetoric on rate cuts, leaving their intentions for the December meeting uncertain. If they do, pressure on the euro may return, which I plan to capitalize on.

In the event of a decline, I would act near the 1.0503 support established earlier today. A failed breakout at this level would justify increasing long positions, aiming for a rise toward 1.0545. A breakout and retest of this range would confirm a valid entry for purchases, targeting 1.0584 and ultimately 1.0620, where I plan to take profits.

If EUR/USD drops further without activity around 1.0503, the pressure on the euro will likely intensify, leading to a deeper decline. In such a scenario, I would only consider entering after a failed breakout near 1.0464. Immediate long positions could also be initiated near 1.0430, targeting a 30-35 point upward correction intraday.

To Open Short Positions on EUR/USD

If the pair continues to rise, protecting the 1.0545 resistance becomes the main task for sellers in the second half of the day. A failed breakout at this level, combined with the market's reaction to FOMC representatives' statements, would provide an entry point for short positions, aiming for support at 1.0503.

A breakout and consolidation below this range, followed by a retest from below, would offer another selling opportunity. The target would be 1.0464, potentially reversing the intraday upward correction seen earlier today. The final target would be 1.0430, where I plan to take profits.

If EUR/USD rises further in the second half of the day and sellers show no activity near 1.0545, I would postpone short positions until testing the next resistance at 1.0584. I would also consider selling there, but only after a failed consolidation. Immediate short positions can be opened near 1.0620, targeting a 30-35 point downward correction.

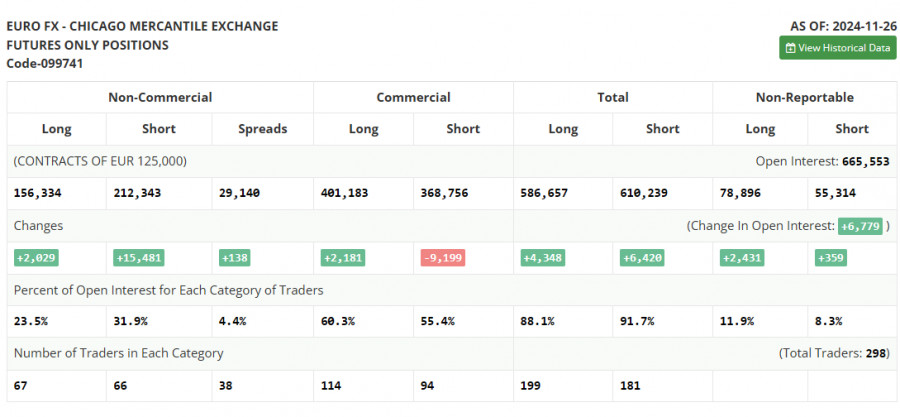

The Commitments of Traders (COT) report for November 26 revealed a significant increase in short positions and a modest rise in long positions:

- Non-commercial long positions increased by 2,029 to 156,334.

- Non-commercial short positions increased by 15,481 to 212,343.

- The net gap between long and short positions widened by 138.

The Federal Reserve's cautious approach to rate cuts enhances the US dollar's appeal compared to riskier assets, including the euro.

Adding to this pressure are Donald Trump's proposed trade tariffs, including the 100% tariffs on BRICS nations, which have heightened uncertainty among investors and increased demand for the dollar.

Indicator Signals

Moving Averages

Trading occurs around the 30- and 50-day moving averages, indicating market uncertainty.

Bollinger Bands

The lower Bollinger Band boundary near 1.0464 acts as support in the event of a decline.

Description of the indicators

• Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart;

• Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the chart;

• MACD indicator (Moving Average Convergence/Divergence – convergence/divergence of moving averages) Fast EMA – period 12. Slow EMA – period 26. SMA – period 9;

• Bollinger Bands. Period – 20;

• Non–profit speculative traders, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total long open position of non-commercial traders;

• Short non-commercial positions represent the total short open position of non-commercial traders;

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.