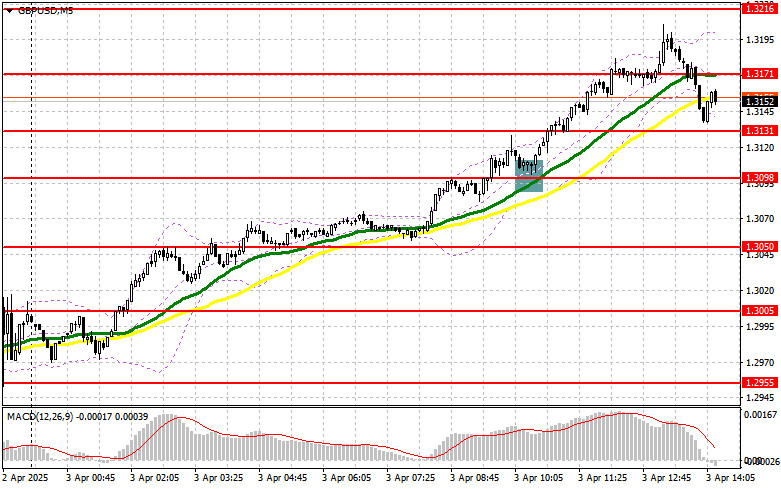

In my morning forecast, I highlighted the 1.3098 level and planned to base entry decisions on it. Let's take a look at the 5-minute chart to see what happened. A decline followed by a false breakout at that level created a long entry point, which resulted in a rise of over 100 points for the pair. The technical picture was revised for the second half of the day.

To open long positions on GBP/USD:

Despite rather weak data on the UK services sector, speculation that Trump's new tariffs will primarily harm the U.S. and its economy — and only secondarily the rest of the world — has fueled demand for risk assets, benefiting the British pound.

Today's U.S. statistics are unlikely to provide meaningful support for the dollar. I'm not sure what kind of figures would be required in jobless claims, the trade balance, or the ISM services PMI to help the dollar recover even part of today's losses. Speeches by FOMC members Philip N. Jefferson and Lisa D. Cook also aren't likely to help much.

If the pair declines, I'd prefer to act near the 1.3131 support level. A false breakout there, similar to the one discussed above, will provide a good entry point into long positions with a target at 1.3171. A breakout with a downward retest of this range will offer another long entry point, targeting 1.3202. The furthest target will be 1.3262, where I plan to take profit.

If GBP/USD drops and bulls remain inactive near 1.3131 in the second half of the day, pressure on the pound will increase significantly. In that case, only a false breakout near 1.3098 will justify new long entries. Otherwise, I'll buy GBP/USD on a rebound from the 1.3057 support level, targeting a 30–35 point intraday correction.

To open short positions on GBP/USD:

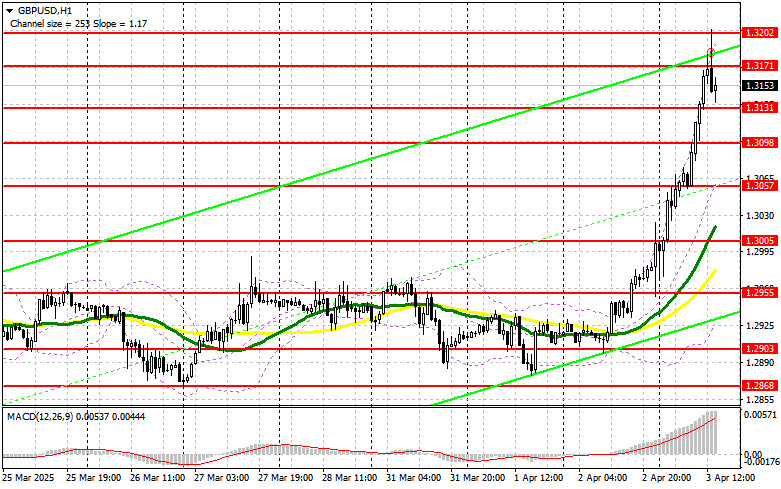

Sellers of the pound don't have much to rely on. Only exceptionally strong U.S. data could trigger a correction in the pair. If GBP/USD continues to rise — which is more likely — I won't rush into selling in such a market.

Only a false breakout near the 1.3202 resistance will provide an entry point for short positions, targeting the newly formed support at 1.3131. A breakout and retest from below would trigger stop-loss orders, opening the path to 1.3098 and hitting buyers hard. The final target will be 1.3057, where I plan to lock in profits. Testing this level may trap the pair within a sideways channel.

If demand for the pound persists in the second half of the day and bears fail to show up at 1.3202, I will postpone selling until a test of the 1.3262 resistance. I'll consider shorting only after a failed breakout. If there's no downward move from that level either, I'll look to open short positions from 1.3301 on a rebound, targeting a 30–35 point correction.

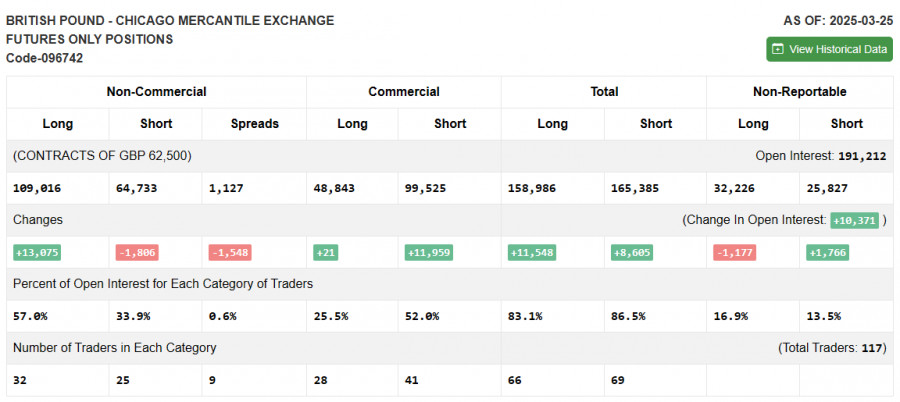

COT Report (Commitment of Traders) – March 25:

The report showed an increase in long positions and a reduction in shorts. Buying interest in the pound continues, which is clearly visible on the chart. While many risk assets have declined, the GBP/USD pair shows stability.

Taking into account the latest inflation figures in the UK and comments from Bank of England officials, the regulator will likely keep its current policy unchanged at the April meeting — a factor that could temporarily support the pound. However, the key issue remains the scale of impact from U.S. tariffs. An increased risk of a global economic slowdown will apply pressure to risk assets, including the pound.

The latest COT report showed non-commercial long positions rising by 13,075 to 109,016, while short positions fell by 1,806 to 64,733. The net position gap narrowed by 1,548.

Indicator Signals:

Moving Averages: Trading is taking place above the 30- and 50-day moving averages, indicating further upside for the pound.

Note: The author uses H1 chart moving averages, which may differ from classic daily MA readings on the D1 chart.

Bollinger Bands: If the pair declines, the lower band near 1.3057 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Identifies the current trend by smoothing volatility and noise. Period – 50 (yellow), 30 (green).

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12, Slow EMA – 26, SMA – 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: The total long open interest held by non-commercial traders.

- Short non-commercial positions: The total short open interest held by non-commercial traders.

- Net non-commercial position: The difference between long and short positions held by non-commercial traders.