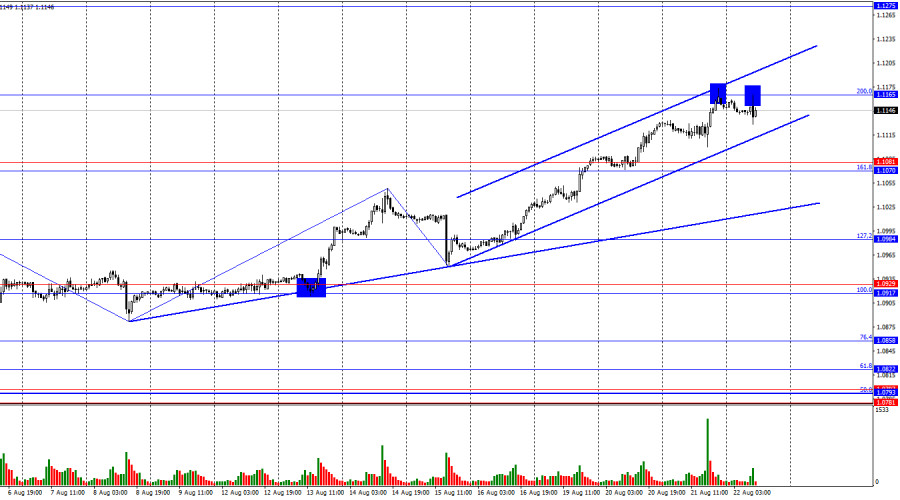

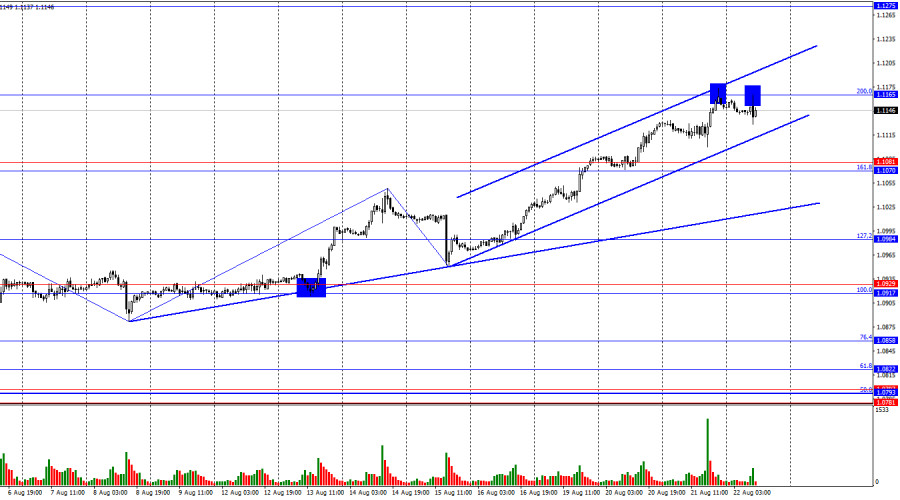

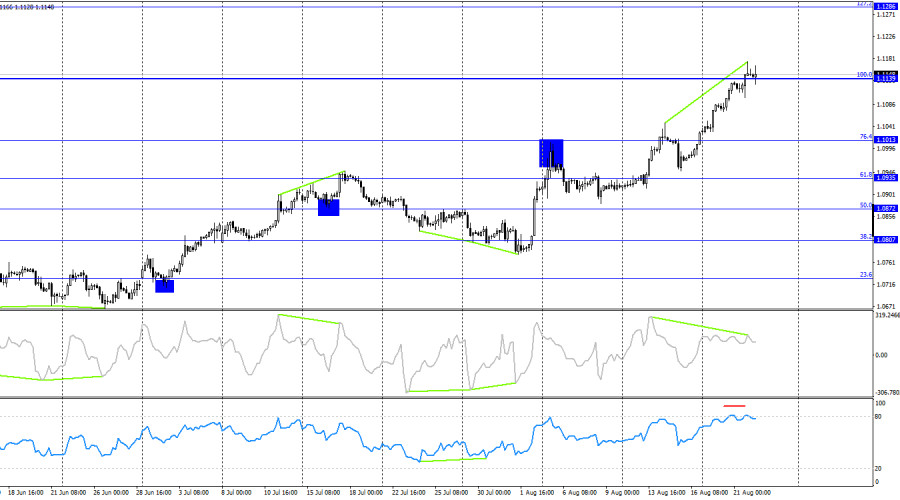

On Wednesday, the EUR/USD pair rose to the 200.0% corrective level at 1.1165. Two rejections from this level currently suggest a possible reversal in favor of the U.S. dollar and a slight decline toward the support zone of 1.1070–1.1081. However, it is not certain that the price will manage to consolidate below the upward trend channel, as the "bullish" trend remains very strong. The pair's growth would likely have continued this morning if the Eurozone business activity indices hadn't been weaker than expected. Consolidation above the 1.1165 level would signal a further rise toward the next Fibonacci level of 261.8% at 1.1318.

The wave situation has become a bit more complex but remains clear overall. The last completed downward wave did not break the low of the previous wave, while the new upward wave broke the peak from August 14. Thus, the "bullish" trend is still intact. For the "bullish" trend to be invalidated, the bears would need to break the low of the last downward wave, which is near the 1.0950 level.

The news flow on Wednesday was nearly nonexistent. Only in the second half of the day did the new Nonfarm Payrolls report (in annual terms) come in weaker than market expectations, triggering a new decline in the U.S. dollar. However, in my view, the decline of the U.S. currency would have continued even without this report, just as it did on Monday or Tuesday. This morning, business activity reports were released in Germany and the Eurozone. Three out of four indicators were weaker than expected. The only positive was the Eurozone services PMI, which rose from 51.9 to 53.3 points. As we can see, the impact of this information was only enough to pause the continuous growth. I don't believe that this pause marks the end. Typically, trends end abruptly, and we are not seeing any sharp reversals at the moment.

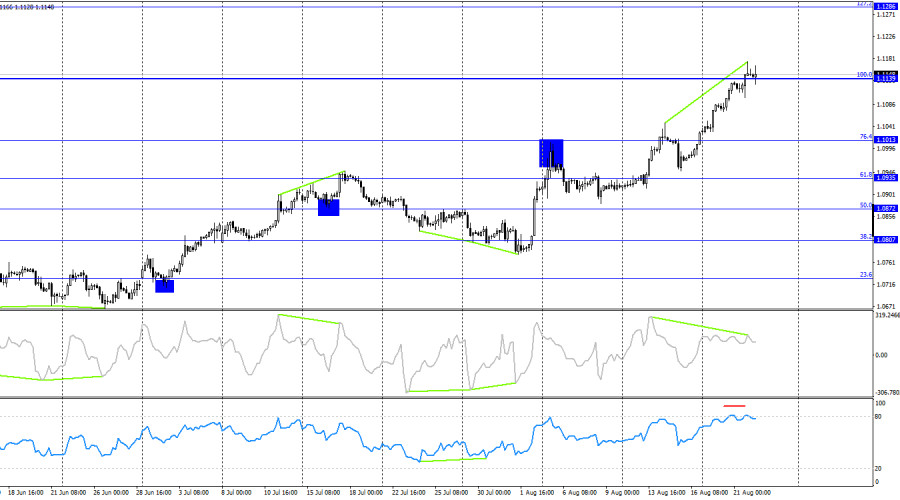

On the 4-hour chart, the pair rose to the 100.0% Fibonacci level at 1.1139 and held just above it. The CCI indicator has been signaling a "bearish" divergence for several days, and the RSI is in overbought territory. Thus, many factors suggest a potential decline in the pair by the end of the week. However, significant growth for the dollar seems unlikely at this point. Even if a downward trend begins, it will take quite some time to obtain the necessary confirmations. For now, I only anticipate a slight downward correction.

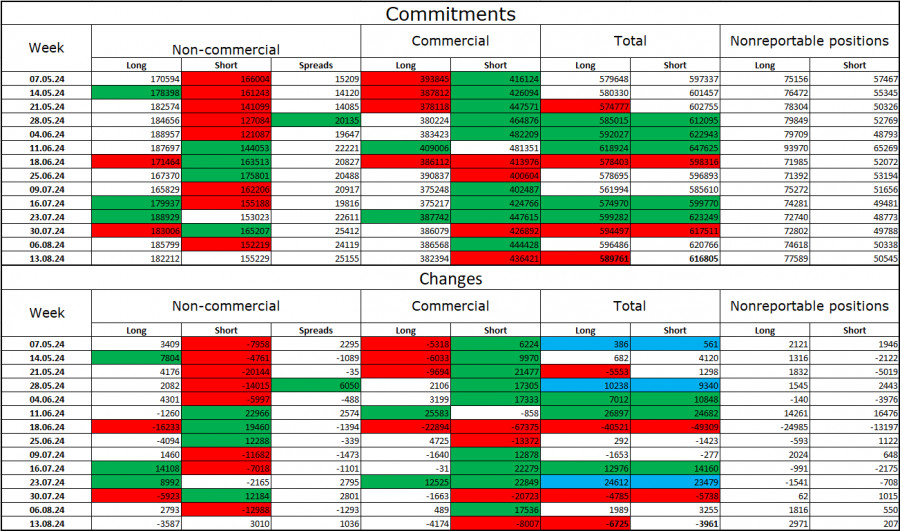

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 3,587 long positions and opened 3,010 short positions. The sentiment of the "Non-commercial" group turned "bearish" several months ago, but bulls have regained dominance. The total number of long positions held by speculators is now 182,000, while short positions total 155,000.

I still believe that the situation will continue to shift in favor of the bears. I see no long-term reasons to buy the euro, as the ECB's monetary easing will reduce yields on bank deposits and government bonds. In the U.S., yields are likely to remain high at least until September, making the dollar more attractive to investors. The potential for a euro decline is significant. However, one should not overlook the technical analysis, which currently does not suggest a strong fall for the euro.

News Calendar for the U.S. and Eurozone:

- Eurozone – Germany Manufacturing PMI (07:30 UTC)

- Eurozone – Germany Services PMI (07:30 UTC)

- Eurozone – Manufacturing PMI (08:00 UTC)

- Eurozone – Services PMI (08:00 UTC)

- U.S. – Initial Jobless Claims (12:30 UTC)

- U.S. – Manufacturing PMI (13:45 UTC)

- U.S. – Services PMI (13:45 UTC)

On August 22, the economic calendar contains a significant number of entries. The impact of the information background on trader sentiment will be notable for the first time this week.

Forecast for EUR/USD and Trading Tips:

Selling the pair today can be considered on a rebound from the 1.1165 level on the hourly chart, targeting 1.1070–1.1081. Purchases were possible upon closing above the 1.1080 level on the hourly chart with a target of 1.1140, which was reached. New long positions can be considered upon the formation of buy signals near the levels of 1.1070–1.1081 or 1.1165 on the hourly chart.

Fibonacci grids are constructed from 1.0917–1.0668 on the hourly chart and from 1.1139–1.0603 on the 4-hour chart.