Wall Street ended Tuesday with mixed results, noting strengthening in the telecommunications, technology, and healthcare sectors. This comes amid a decline in the oil and gas sector, commodities, and industrial segments.

New employment data suggests that the Federal Reserve System of the USA may soon move to reduce interest rates.

Leading companies on Wall Street showed growth, thanks to a decrease in the yield of treasury bonds to levels not seen for several months. Shares of Nvidia (NVDA.O) and Apple (AAPL.O) rose by more than 2%, while Amazon (AMZN.O) and Tesla (TSLA.O) increased by more than 1%.

Most of the S&P 500 sector indices showed a decline, following data indicating a decrease in the number of available job openings in the USA in October to the lowest level since the beginning of 2021. This is a sign of weakening in the labor market."

"Considering the increase in interest rates and the decline in demand, companies are reducing the number of job openings, which is one of the goals of the Federal Reserve System," notes Sam Stovall, Chief Investment Strategist at CFRA Research in New York.

"The Fed has most likely already completed its cycle of rate hikes, and now the question is when they will start reducing them," predicts Stovall.

An additional report indicates an increase in activity in the U.S. services sector for November.

The S&P 500 index fell by 0.06%, closing at 4,567.18 points.

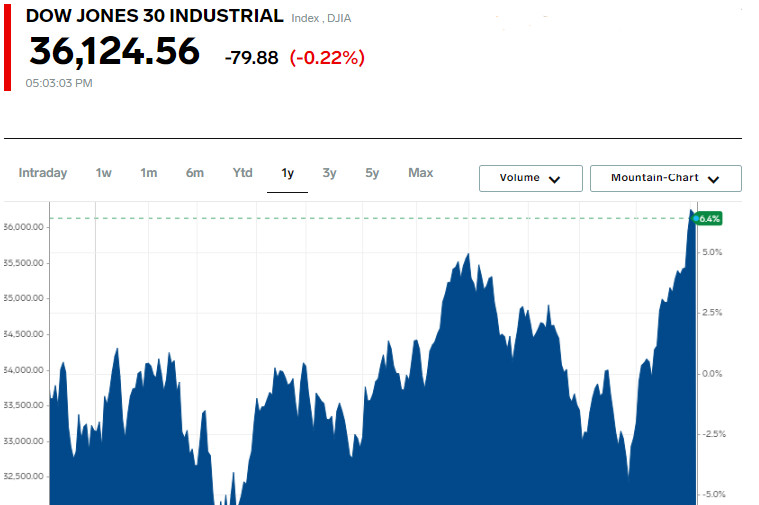

In contrast, Nasdaq showed an increase of 0.31%, reaching 14,229.91 points, while the Dow Jones Industrial Average decreased by 0.22% to 36,124.56 points.

Among the companies showing significant growth within the S&P 500 index, notable are MarketAxess Holdings Inc (NASDAQ:MKTX) with an increase of 5.33% to 251.27, Discover Financial Services (NYSE:DFS) with a gain of 4.59%, closing at 99.09, and Alaska Air Group Inc (NYSE:ALK), whose shares rose by 4.36%, ending trading at 35.56.

Among the leaders of growth in the Dow Jones index are the shares of Apple Inc (NASDAQ:AAPL), which rose by 3.99 points (2.11%), closing at 193.42. Shares of Merck & Company Inc (NYSE:MRK) increased by 1.21 points (1.15%), ending trading at 106.27. Securities of Verizon Communications Inc (NYSE:VZ) rose by 0.40 points (1.05%), closing the session at 38.44.

The Russell 2000 index, representing smaller capitalization companies (.RUT), decreased by 1.4%, breaking its four-day positive streak.

Trading volume on U.S. exchanges was significant: about 11.9 billion shares, exceeding the average volume of 10.6 billion shares over the last 20 sessions.

Out of the eleven S&P 500 sector indexes, eight showed a decline, with the most significant drop observed in the energy sector (.SPNY), which decreased by 1.7%. It was followed by the materials sector (.SPLRCM) with a decrease of 1.37%.

American stock markets went through uneven sessions this week, after the S&P 500 index soared almost 9% in November. On Friday, the index reached its four-month high for the day.

Overall, stock market investors assume that the Fed will leave interest rates unchanged at its upcoming meeting next week. Futures on interest rates also show a 65% probability of a rate cut at the Fed's March meeting, according to the CME Group's FedWatch tool.

On Friday, a more detailed report on non-farm employment for November will provide more information about the state of the labor market.

Strategists from BlackRock predict that in 2024, global markets will face increased volatility as the Fed will cut key interest rates fewer times than futures markets expect. Shares of Take-Two Interactive Software (TTWO.O) fell by 0.5% after the showcase of a trailer for a new installment of the hit game "Grand Theft Auto".

Shares of CVS Health (CVS.N) rose by 3.7%, thanks to annual revenue forecasts that exceeded Wall Street expectations, based on the expansion of healthcare services.

In the S&P 500, declining stocks prevailed over rising ones, with a ratio of 4.5 to one.

The S&P 500 index recorded 15 new highs and showed no new lows; Nasdaq marked 83 new highs and 69 new lows.

In the currency market, the EUR/USD pair was almost unchanged, losing 0.36%, and reached 1.08, while the USD/JPY pair decreased by 0.01%, reaching 147.18.

Futures on the U.S. dollar index rose by 0.26%, reaching 103.92.